EMX DCS Automation Vendors Analysis Report

Project: DCS Automation Vendors Analysis Report

Timeline

Start Date: September 20 2018

Report Generation: September 20-October 26 2018

Workgroup + User Research: September 20-October 26 2018

Project Assignments and Requirements: September 24-28 2018

Project Planning and Data Aggregation: October 01-06

Project Execution: Report + User Groups + Technical Library: October 01-06 + October 08-13

Project Portal: October 01-06 + October 15-19

Project Extracts and Raw Data Portal Aggregation: October 07-21

Report Digitization (portal+slides+extracts): October 08-26

Report Review: October 29

Report Completion October 31

Work Group – User Group Teams

Project Leads: AnilMGS + PeterEMR + DavidMX

EMX Projects Workgroup – projects@emerson.machine.exchange / https://emerson.machine.exchange

EMX Support Workgroup – support@emerson.machine.exchange / https://emerson.machine.exchange

MGS+ DCS Engineering User Group (Egypt-MENA)

MGS+ DCS Management User Group (India)

MG Strategy+ Projects Work Group

Cloud Presentations

Projects Workgroup – Emerson Machine Exchange

Google Drive

user email: projects@emerson.machine.exchange

user password: gm2!lGooGl3Dr*&V

https://drive.google.com

DCS Automation Vendors Analysis Report Slides

Google Drive Slide Presentation: https://docs.google.com/presentation/d/1cbN0PLagJ-qXsFmk3Z2FJ6Z-CLYLLqr-n5CFBOCAkg8/edit

Executive Summary

As we continue to approach projects from an investment perspective, the focus remains on demonstrating cost effective, reliable, scalable, flexible control solutions by combining and integrating present best-in-class and future-relevant technologies; protecting and enhancing client capital and technology investments with a focus on competitive expansion, integration and maintenance costs; supporting and enhancing efficient and sustainable investment; facilitating competitive life cycle costs, and reducing total cost of ownership. Discussions are being had industry wide around the digital transformation of production facilities – what it looks like, how best to implement and the Return on Investment (ROI).

With much to consider when selecting a DCS upgrade or control system replacement, OEM’s play a vital role in advancing the customer outlook towards their firms based on the technological direction their firms are going, how R&D funds are focused and the consideration given to deal with the evitable challenges that arise during project execution. Unless these market entry points are addressed appropriately and timely, the product technical information on I/O hardware, Sequence of Events (SOE) Modules, Relay Outputs, I/O Module flexibility, footprint and orientation, wire terminations, controller and interface hardware, which are all key considerations when selecting a DCS, will be fruitless.

The ability of an OEM team to communicate that their product and services is core to a customer’s effort to increase effectiveness and efficiency of its operations is critical.

Being able to answer the following questions to the satisfaction of the customer at the initiation of a this process will elevate your teams’ standing:

1. How does your team ensure customer facility has uninterrupted process execution

2. Are you providing customer staff the tools to optimize production?

3. Does your product have the characteristics of a proven and innovative solution

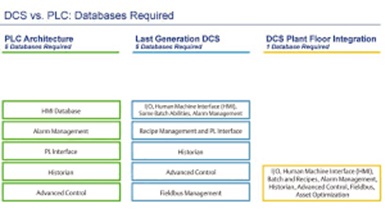

4. How robust is your DCS as it relates to built-in redundancy, one data ownership and integrated environment

5. How is the technology being proposed meet the customer requirements

6. How much standardization and pre-built templates exist so that the engineering and operational efforts are easier

7. What’s the flexibility in expansion

Table of Contents

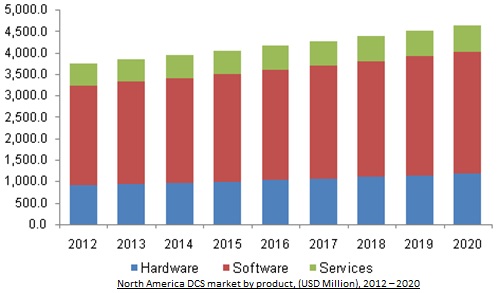

1. Automation Market Overview

https://emerson.machine.exchange/automation-market-overview-extract/

A brief overview of the global and US market, with synopsis on over 5 vendors

2. Customer considerations in selecting a Automation vendor

https://emerson.machine.exchange/customer-considerations-extract/

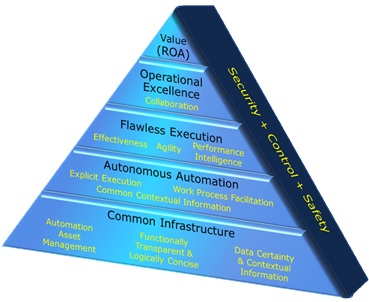

Return on Assets, Operational Excellence, Effectiveness and Visualization, Automation and Empowerment, Automation Asset Management, Data Certainty and Traceability

3. Understanding the Customer Selection Process

https://emerson.machine.exchange/understanding-the-process-extract/

As a partner to the customer, unless you understand where in the process the customer is and what hurdles they face, how can you provide valuable input, which ultimately facilitates selection

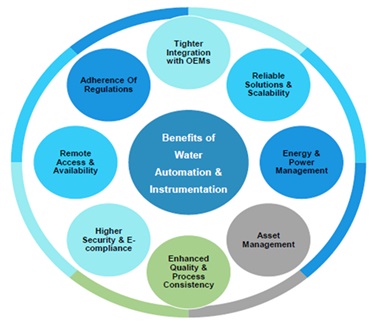

4. Market Drivers

https://emerson.machine.exchange/market-drivers/

What are the drivers that determine the decision to purchase or upgrade an Automation system

5. Global Leadership within this Sector

https://emerson.machine.exchange/global-dcs-leadership/

Global DCS Leadership within this Sector – ABB Ability System 800xA and ABB Ability Symphony® Plus

https://emerson.machine.exchange/advantages-of-the-ovation-dcs/

Advantages of the Ovation DCS – Demonstrating Advantages of the Ovation DCS to your PLC based Customers

6. Industrial Protocols used within Utility Sector

https://emerson.machine.exchange/dcs-industrial-protocols/

DCS Industrial Protocols Used within Industry

7. High Level Corporate and Product SWOT Analysis – Corporate and Product

For Schneider Electric, Emerson, Rockwell, Honeywell, Siemens, ABB

SWOT Analysis – Schneider Electric

https://emerson.machine.exchange/schneider-electric-swot/

SWOT Analysis – Emerson

https://emerson.machine.exchange/emerson-electric-swot/

SWOT Analysis – Rockwell

https://emerson.machine.exchange/rockwell-automation-swot/

SWOT Analysis – Honeywell

https://emerson.machine.exchange/honeywell-swot/

SWOT Analysis – Siemens

https://emerson.machine.exchange/siemens-swot/

SWOT Analysis – ABB

https://emerson.machine.exchange/abb-swot/

8. High Level Peer Review

Between Emerson, Siemens, Schneider and Rockwell for Product Capabilities, User Reviews, Customer Experience

https://emerson.machine.exchange/dcs-vendor-peer-review/

9. High Level Product Review

Schneider Electric | Siemens | Rockwell Automation | Emerson

Comparative Analysis DCS Automation Vendors Worksheet – IUG + EUG

User Groups Data

Comparative Analysis Automation Vendors Worksheet – IUG & EUG

https://emerson.machine.exchange/multi-dcs-vendor-swot/

10. Emerson Digital – Emerson Power and Water’s Vision and Ability to Execute

https://emerson.machine.exchange/emerson-digital/

Media

end

Tags: Analysis,Automation Vendors,digital,Report,